-

English

-

French

-

Korean

-

Portuguese

-

Russian

-

Spanish

English

French

Korean

Portuguese

Russian

Spanish

Over the past decade, energy storage has been dominated by utility-scale mega-projects—large 50–200 MW plants designed to stabilize national grids. But in 2024–2025, a different segment is quietly stealing the spotlight: Commercial & Industrial (C&I) energy storage, particularly systems in the range of 500 kW to 2 MWh.

From factories in South Africa to cold-storage facilities in Southeast Asia and logistics parks in Europe, this size band has suddenly become the “sweet spot” of the global market. And the reasons behind this shift reveal a major structural change in how businesses think about electricity.

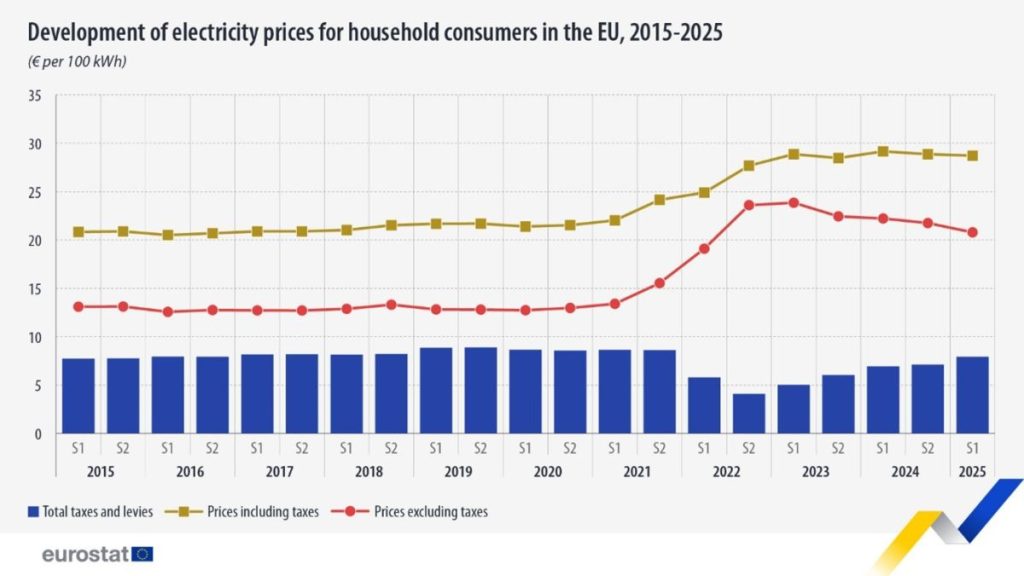

Across most regions, industrial customers are exposed to increasingly unpredictable electricity costs. Key drivers include:

In Europe, industrial electricity prices more than doubled between 2021 and 2023, according to Eurostat.

In the U.S., peak vs. off-peak tariffs continue to widen, with demand charges contributing up to 50% of monthly bills (U.S. EIA).

And in emerging markets such as South Africa, the Philippines, and Pakistan, frequent grid outages amplify the problem—businesses aren't just paying more, the're losing productivity.

A 500 kW–2 MWh system is large enough to shave peak loads AND provide backup power, without requiring the capital intensity of a utility-scale plant.

Battery prices have fallen more than 80% in the past decade. BloombergNEF reports that LFP pack prices are approaching $100/kWh in 2024–2025:

This single trend makes C&I storage economically viable for the first time.

At today's prices:

When a technology crosses the “economic tipping point,” adoption accelerates exponentially—and that is exactly what is happening now.

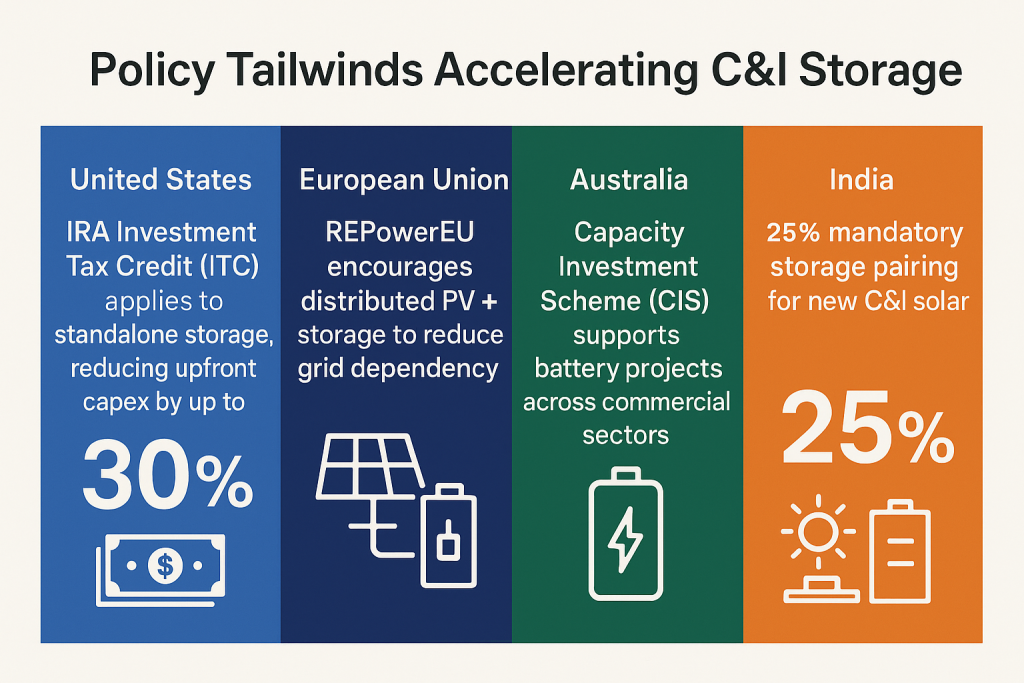

While utility-scale incentives get most of the headlines, many governments are quietly shaping policies that favor mid-scale C&I deployments.

Examples include:

The direction is consistent across markets: decentralized, flexible, customer-side storage is now a policy priority.

C&I customers are no longer thinking only in terms of cost savings. Their mindset has shifted toward resilience and control.

Top motivations reported in multiple markets include:

McKinsey highlighted in 2024 that distributed energy resources (DERs) will form the backbone of future corporate energy strategies:

A 500 kW–2 MWh ESS is the perfect scale for these goals—small enough to deploy quickly, but big enough to deliver real autonomy.

As solar becomes cheaper and more widespread, pairing it with mid-scale storage is increasingly logical:

In 2023, more than 30% of new C&I solar projects in Southeast Asia were installed with storage, according to IRENA.

In many regions, PV-only projects can no longer unlock their full value—storage completes the system.

The technical ecosystem around C&I storage has become more standardized and robust in the last two years:

This means businesses no longer need months of engineering and custom design; a 1 MWh system can be deployed like an appliance.

Because it fits the typical load profile of modern businesses:

A single system in this size band allows customers to:

Simply put: this size band perfectly aligns with the energy economics of the C&I sector.

C&I energy storage is no longer an experimental technology or a niche solution. It is becoming a mainstream business asset, as fundamental as forklifts, servers, or backup generators.

The global shift from “grid dependence” to “energy autonomy” has begun—and the companies that adopt 500 kW–2 MWh systems today are positioning themselves at the forefront of this transformation.

As the world moves into 2025, one thing is clear: C&I storage is not just exploding—it's redefining how businesses think about power.

Explore the latest news and technology trends in the energy storage industry.